High hopes for a strong market 2021-2022

It is sometimes said that the darkest hour is just before dawn. Let us hope that is true, as it has now been dark for a long time – both figuratively and literally.

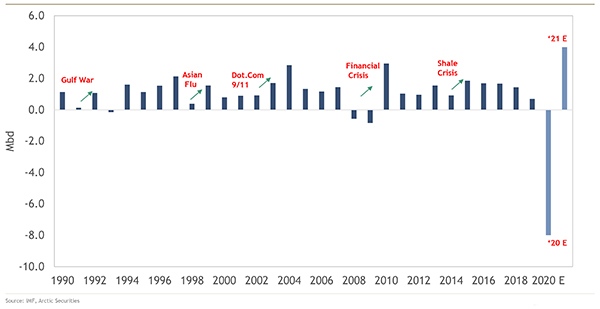

As we approach the end of 2020, we can see that the last few months have unfortunately been just as grim as we predicted for the tanker market. Since summer, lower oil consumption due to Covid-19 and OPEC’s largest ever oil production cuts – and therefore stock withdrawals close to the consuming countries – have hung like a heavy, wet blanket over demand for tanker transport. And right now, it is weaker than ever.

Product tanker spot earnings ($000's/day)

Gradual turnaround in 2021

At the moment, we actually think that the above saying is true. Our view of future development for the tanker market remains positive. Despite numerous uncertainty factors related to the external environment, we expect the market to become gradually stronger in the coming year. The reasons are several.

If we look at demand for oil, we note that, despite a second Covid-19 wave, consumption continues to recover at a relatively good pace. At the time of writing, in November, consumption amounts to 95.6 million barrels per day (according to the EIA). In the coming winter months, it is expected to continue to increase to approximately 96 million barrels per day. Compared with the low in April, this represents a substantial and, given the situation, relatively rapid recovery. It is then expected to continue to rise, approaching 100 million barrels per day during the second half of next year, i.e. largely the same as before the pandemic. And it should also be noted that Asia is expected to account for about 75 percent of the recovery – which means longer transport distances and an increased need for transport.

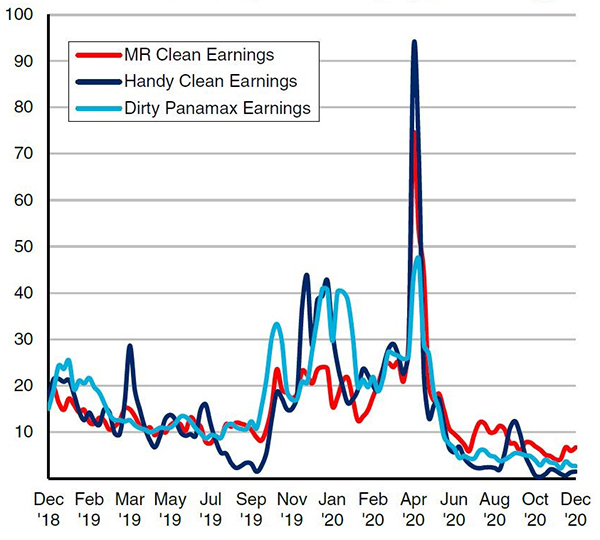

If we look in the rear-view mirror at previous global crises, we can also see that a temporary decline in demand for oil – and by extension tanker transport – has often been followed by a sharp, sometimes almost disproportionate, upturn. When a turnaround comes, it is usually significant. Psychology sometimes plays a major role in tanker shipping, just as in other markets.

Growth in world oil demand, 1990–2021E (click on image to enlargen)

Decreasing inventories

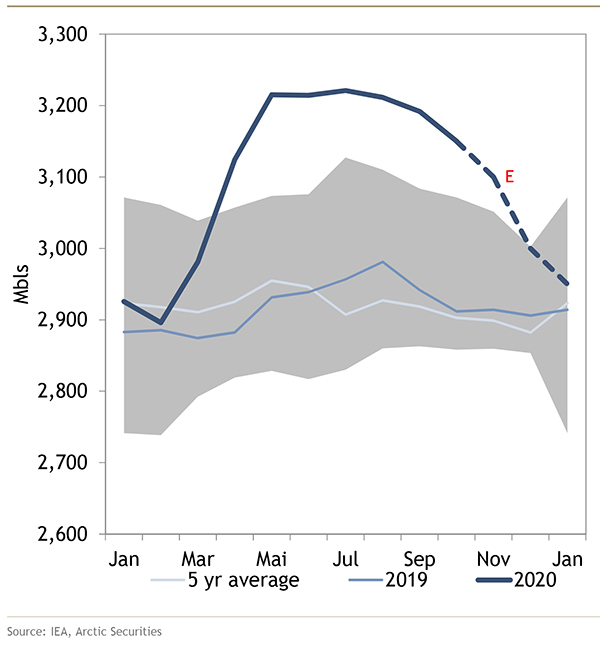

The combination of increased oil consumption and continuing production cuts means that the large stocks built up during spring are now gradually decreasing – perhaps not at the pace we previously expected, but they are clearly moving in the right direction and we expect them to be down to the five-year average during Q1 2021. The effect of this is obviously expected to have a positive effect on the tanker market.

OECD inventories vs 5-year average

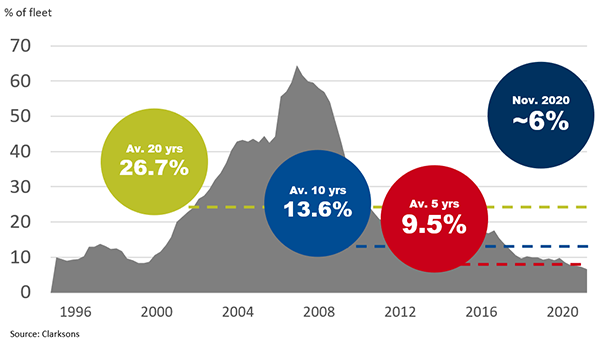

Record-low order book

Moving to the supply side, things look really exciting. At the time of writing, the total order book for the product tanker segment is at 6 percent of the total tanker fleet, the lowest level in 25 years. There are still virtually no new orders being placed, which is, of course, positive for the market, both now and in the long term.

Orderbook in % of fleet (product tanker 10k+)

Not surprisingly, there are many question marks and uncertainties – particularly regarding the consequences of Covid-19 and the long-term impact of the virus on the world economy. However, progress in the development of an effective Covid-19 vaccine instils hope and confidence in the future in a global community that has suffered greatly. This is certainly needed. 2020 has been a tough and challenging year in many ways. We now look forward, with cautious optimism, to embracing 2021. Given developments in the tanker market, both 2021 and 2022 now look like they could be really exciting years.

With this said, we want to wish you all Happy Holidays and warm wishes for a safe New Year!

Kim Ullman, President